how to lower property taxes in maryland

The Maryland Tax Court is an independent body appointed by the Governor. What Strasser doesnt like is when his property taxes go.

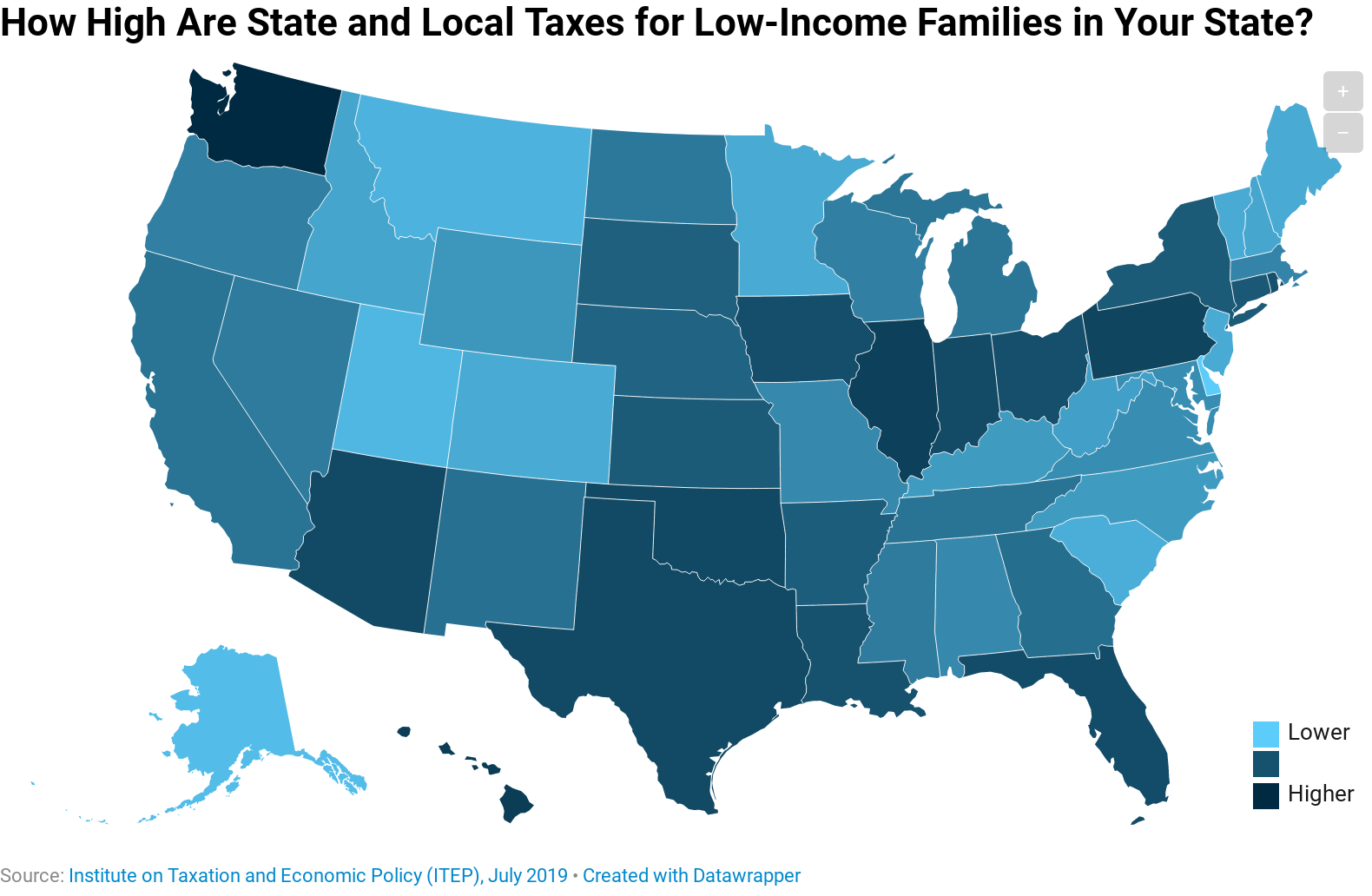

Property Taxes How Much Are They In Different States Across The Us

The estate tax falls on the estate of the person who died.

. If you own any type of property in Maryland you must pay property tax. Use our tips and you will find your property tax woes can become a thing of the past. DoNotPay Helps You Reduce Your Maryland Property Tax Bill.

This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland. Maryland Property Taxes. Property tax can be confusing at the best of times but DoNotPay is here to help.

For more information please call 410-996-2760 or email at sdatperspropmarylandgov. So if your property is assessed at 300000 and. Taxes are calculated by dividing the taxable assessment by 100 and then multiplying by the tax rate.

Only households with a total gross income of less than 60000 are eligible for this credit. What is the property tax rate in Baltimore. How to Appeal PropertyTaxes in Maryland.

Mortgage Relief Program is Giving 3708 Back to Homeowners. The beneficiaries or heirs inherit whats left. Current Year Tax Rates per 100.

Check Your Eligibility Today. In past years the governor has been successful in enacting retirement tax relief for law. The average effective property tax rate is Baltimore is 165 higher than any of Marylands counties.

The Retirement Tax Reduction Act will eliminate 100 of state retirement taxes in Maryland providing 4 billion in cumulative relief to deserving retirees. Taxes on real estate in Maryland account for about 35 of city budgets and 30 of county budgets funding local services like public education and fire protection. Homestead Credit for senior citizens the credit amount is 25 of the tax owing in the current year after applying the Homestead Credit.

Last year roughly 51000 homeowners received an average credit of 1213. As an example a household with a gross income of 30000 will receive a credit for any property tax. It is in addition to the homestead credit in 9-105 of the Tax Property Tax Articles of the Maryland Annotated Code.

Property taxes are quite possibly the most widely unpopular taxes in. If you are dissatisfied with the decision made by the Property Tax Assessment Appeals Board you have the option to file an appeal to the Maryland Tax Court MTC within 30 days of the date of the PTAAB order. Tax relief is phased in over time using an income exclusion and begins in tax year 2022.

However homeowners who do not receive any tax credits may pay even higher rates. Our app features a Property Tax tool that can create a customized guide to how you can reduce your property tax bill. The exact property tax levied depends on the county in Maryland the property is located in.

Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year. Maryland residents are potentially subject to both an inheritance tax and an estate tax. Maryland also levies an inheritance tax on people who inherit property in that state.

Tax rates are set by the County Council each fiscal year. A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own. The rates are based on 100 of assessed value taxable assessment.

The credit caps property taxes based on income level. This tax collected by the county is typically earmarked for a number of uses from roads and parks to schools. The tax levies are based on property assessments determined by the Maryland Department of Assessments and.

Using an effective tax rate of 108 per 100 for this example 100 local property tax plus 08 state property tax the amount of property taxes due would be calculated like this. The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland. Howard County collects the highest property tax in Maryland levying an average of 426100 093 of median home value yearly in property taxes while Garrett County has the lowest property tax in the state collecting an average tax of 117300 069 of median home value.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. The city of Baltimore has some of the highest property tax rates in the entire state of Maryland. Home office while his wife takes golf lessons on the green behind their two-bedroom home.

Joel Strasser likes to write from his Brick NJ. This detailed report tells you everything you need to know about reduc. Feeling faint after opening your property tax bill.

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. 100000 divided by 100 times 108 which equals 108000. In Maryland county governments collect an average of 087 percent of a propertys assessed fair market value as property tax each year.

Take a deep breath. In part due to the tough national and state economy as well as increasing farm production costs many family farms in Maryland face growing economic burdens. The law requires taxpayers to properly address mail and ensure the 2018 tax return.

Marylands estate tax is levied on estates of more than 5 million. For more information call the Maryland Tax Credits Telephone Service at 410-767-4433 or 1-800-944-7403 or visit the Maryland Tax Credit Programs and Exemption Information page online. Marylands average effective tax rate of 110 is lower than the national average.

In a move signaling wide bipartisan support Maryland Governor Martin OMalley a Democrat has spoken out in favor of a Republican bill to lower agricultural taxes. 11 hours agoIf they do not file a 2018 tax return by April 18 2022 the money becomes the property of the US.

Deducting Property Taxes H R Block

Real Property Tax Howard County

Property Taxes Calculating State Differences How To Pay

How Taxes On Property Owned In Another State Work For 2022

How To Lower Your Property Taxes Youtube

Pin By Cutmytaxes On Property Tax Appeal In 2021 Property Tax Hb2 Symbols

Solar Property Tax Exemptions Explained Energysage

Pin By Cutmytaxes On Property Tax Reduction In 2021 Property Tax Tax Reduction Tax

Property Tax Comparison By State For Cross State Businesses

Maryland To Issue Millions Of Dollars In Property Tax Credit Refunds Before The End Of The Year

Montgomery County Md Property Tax Calculator Smartasset

A Breakdown Of 2022 Property Tax By State

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Taxes Calculating State Differences How To Pay

Florida Property Tax H R Block

Thinking About Moving These States Have The Lowest Property Taxes

Property Tax Prorations Case Escrow

Cool Property Tax Appeals To Lower Property Taxes Find Your Reason To Appeal Property Tax Guide Book Finding Yourself